34+ paying off mortgage early penalty

Lock In Lower Monthly Payments When You Refinance Your Home Mortgage. Web Is There a Penalty For Paying Off My Mortgage Early.

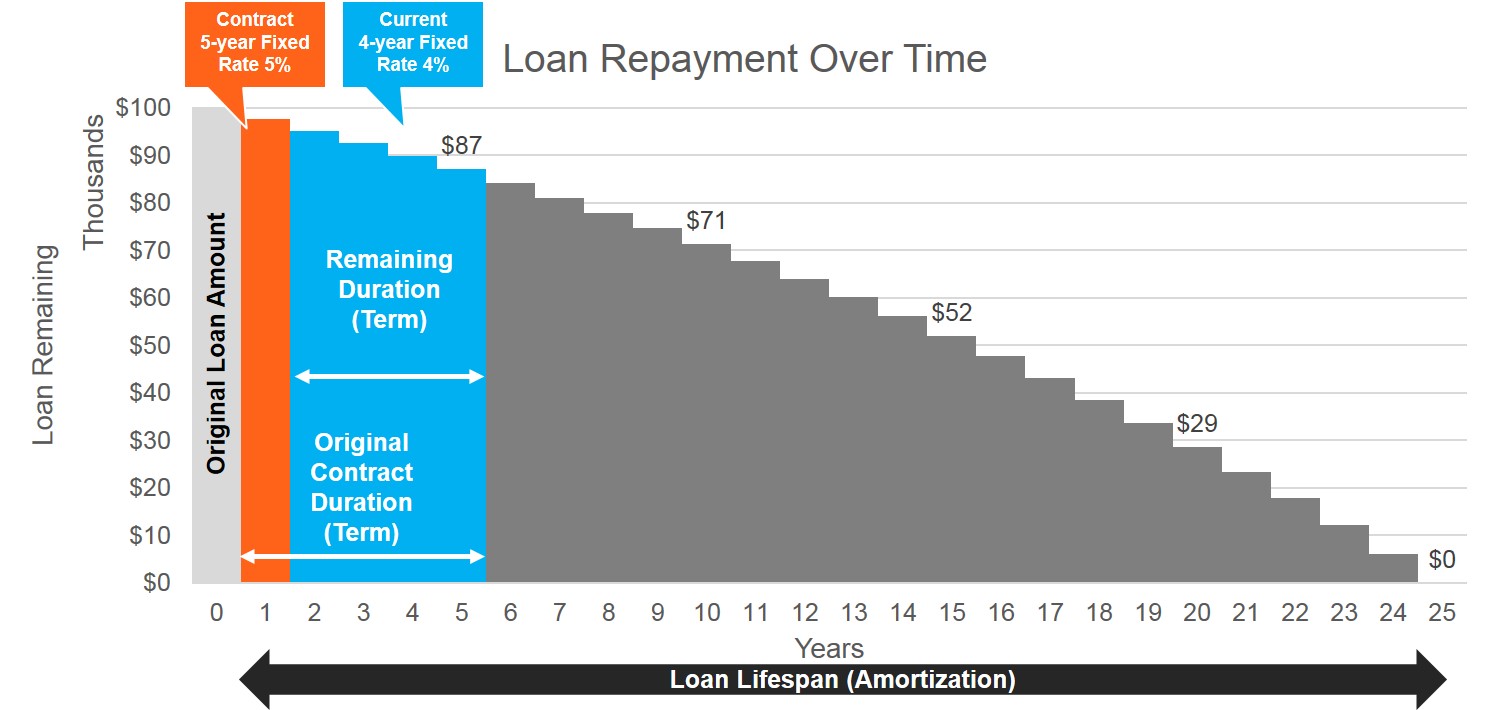

Mortgage Prepayment Penalty Interest Rate Differential And Three Month Interest Calculations

Financial goals and life.

. See if you qualify. Multiply your current interest rate. If the refinance lowers your monthly payment by 200.

Web Before you decide to pay off your mortgage early consider the following. Web How To Calculate The Blended Interest Rate. For the third year the.

Web Paying off your loan early can save you hundreds or even thousands of dollars in interest but if your loan has a prepayment penalty you may get stuck with a fee. Web August 16 2022. The easiest way to pay off your mortgage early is by making extra payments ideally toward the principal loan amount.

Web A prepayment penalty is a fee that your mortgage lender may charge if you. Web Paying off your mortgage early could be a good idea if you can spare the cash and interest savings outweigh potential investment gains. Web Up to 25 cash back For the first two years after the loan is consummated the penalty cant be greater than 2 of the amount of the outstanding loan balance.

Web Some loans have pre-payment penalties during the first years of the loan. Ad Dedicated to helping retirees maintain their financial well-being. Early Pay Off Penaltie s also referred to as EPOs are often confused with Prepayment Penalties.

Though Wells Fargo doesnt have prepayment penalties you could potentially face prepayment. Web Some closed-term agreements allow you to pay off 10-20 of principal once a year but outside of that you will have to pay your lender a penalty fee for doing. Web So if your outstanding loan balance in year two is 295000 and you pay your mortgage off the lender could charge a prepayment penalty of up to 5900.

Steps to calculate a blended interest rate Example Enter your information. The EPO meaning in mortgage language. These fees may impose substantial costs on homeowners with adjustable rate mortgage.

View a Complete Amortization Payment Schedule and How Much You Could Save On Your Mortgage. Web A prepayment penalty is a fee that some lenders charge if you pay off all or part of your mortgage early. Pay more than the allowed additional amount toward your mortgage break your mortgage contract.

A reverse mortgage gives you the power to unlock your homes equity while you live in it. With 6 months of interest charged your lender would. You may have to pay a prepayment penalty if you pay off your mortgage within the first few years of the.

Web Make extra mortgage payments. Web For example imagine youre looking at a 4000 penalty to pay off your mortgage early via a refinance. Ad How Much Interest Can You Save by Increasing Your Mortgage Payment.

Web An interest-based mortgage prepayment penalty is charged if the loan is paid off within the first 3 years. Ad Shortening your term could save you money over the life of your loan. If you have a prepayment penalty you would have agreed.

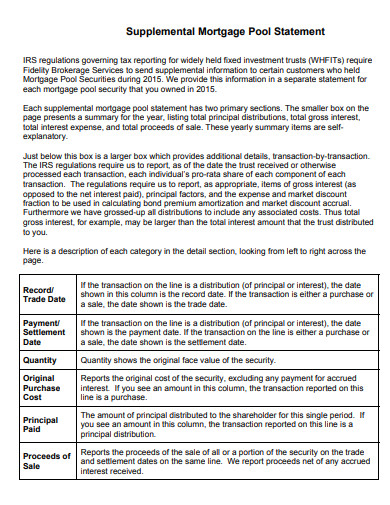

Mortgage Statement 10 Examples Format Pdf Examples

Is There A Penalty For Paying Off Your Mortgage Early

Penalties For Early Mortgage Repayment Prepayment Mortgage Sandbox

Prepayment Penalty Description Avoiding It Guaranteed Rate

Mortgage Statement 10 Examples Format Pdf Examples

Early Repayment Penalty When Selling A House

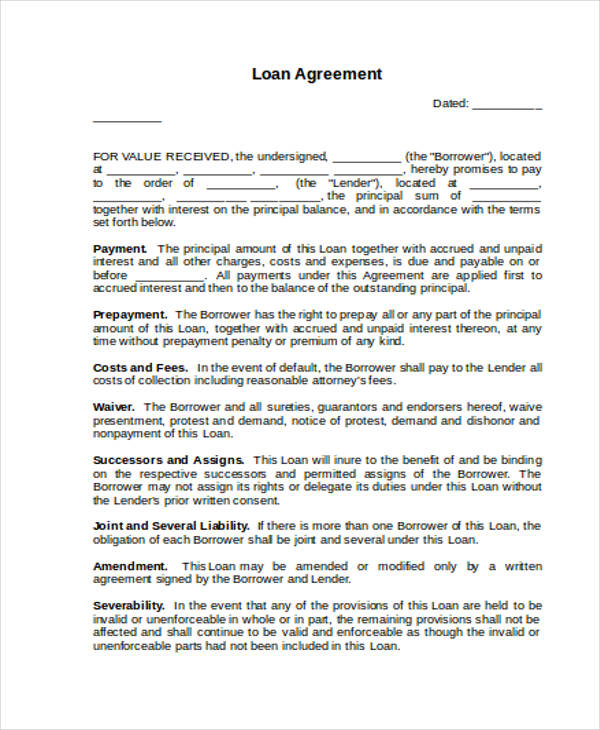

Free 34 Loan Agreement Forms In Pdf Ms Word

Should I Pay Off My Mortgage Early Or Not My Money Design

Mortgage Statement 10 Examples Format Pdf Examples

4 Simple Ways To Pay Off Your Mortgage Early Seedtime

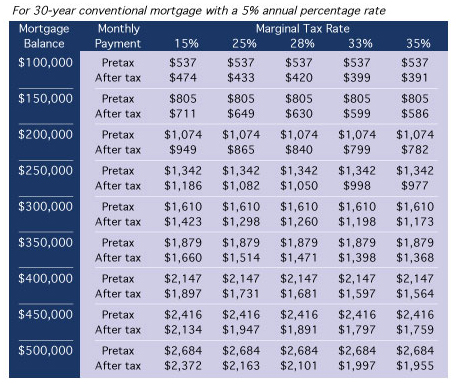

Think Twice Before Paying Off Your Mortgage Early Knowledge At Wharton

How To Pay Off Your Mortgage In 5 7 Years Build Wealth Live Debt Free Youtube

Next Generation Filmakers 021920 By Toronto Caribbean Newspaper Issuu

Is There A Penalty For Paying Off Your Mortgage Early

Should You Pay Off Your Mortgage Early Moneyunder30

Are There Disadvantages To Paying Off Your Mortgage Early Level Financial Advisors

Early Repayment Penalty When Selling A House